Barter Agreement Vat . we use the term barter transaction to denote a transaction in which no monetary payment is made. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. vat & barter transactions. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. It is a term of convenience and. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a.

from uroomsurf.com

barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. we use the term barter transaction to denote a transaction in which no monetary payment is made. there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a. vat & barter transactions. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. It is a term of convenience and.

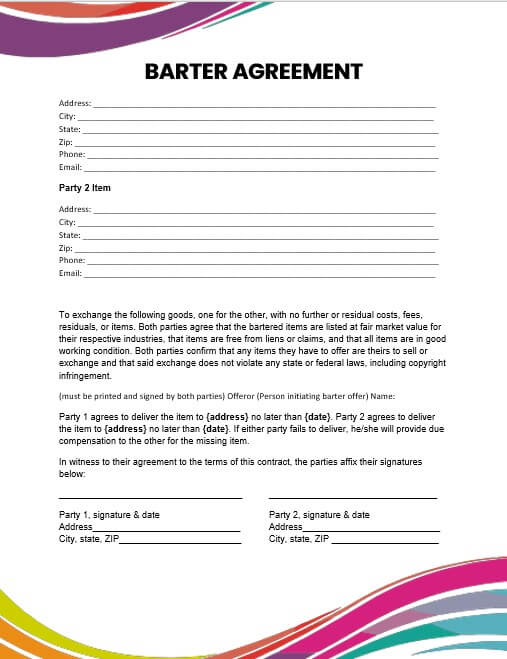

10+ Barter Agreement Template room

Barter Agreement Vat We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a. It is a term of convenience and. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. we use the term barter transaction to denote a transaction in which no monetary payment is made. vat & barter transactions.

From ar.inspiredpencil.com

Barter Trade Barter Agreement Vat calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. vat & barter transactions. there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a. barter transactions pose the greatest risk to the recipient of. Barter Agreement Vat.

From sample-templates123.com

Barter Agreement Template Free Sample, Example & Format Templates Barter Agreement Vat We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. It. Barter Agreement Vat.

From eforms.com

Free Barter Agreement Template Sample PDF Word eForms Barter Agreement Vat calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. It is a term of convenience and. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. vat & barter transactions. We look at an often overlooked, unusual vat. Barter Agreement Vat.

From www.rocketlawyer.com

Free Barter Agreement Make, Sign & Download Rocket Lawyer Barter Agreement Vat barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. vat & barter transactions. calculating vat (value added tax) for barter transactions is more complex than for standard cash. Barter Agreement Vat.

From legalgoodness.com

Barter Agreement Template Legal Goodness Barter Agreement Vat vat & barter transactions. calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. It is a term of convenience and. barter transactions pose the greatest risk to the recipient of a. Barter Agreement Vat.

From bootstrappingwithoutboots.com

A Sample Barter Agreement Barter Agreement Vat there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a. vat & barter transactions. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. barter transactions can create unanticipated vat liabilities and may have other. Barter Agreement Vat.

From whoamuu.blogspot.com

Advertising Barter Agreement Template HQ Printable Documents Barter Agreement Vat vat & barter transactions. calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. It is a term of convenience and. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. there is a barter transaction under which. Barter Agreement Vat.

From old.sermitsiaq.ag

Barter Contract Template Barter Agreement Vat We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. vat & barter transactions. It is a term of convenience and. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. we use the term barter transaction to denote a transaction in which. Barter Agreement Vat.

From www.template.net

Barter Trade Agreement Template in Word, PDF, Google Docs, Pages Barter Agreement Vat We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. we use the term barter transaction to denote a transaction in which no monetary payment is made. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. barter transactions pose the greatest risk. Barter Agreement Vat.

From uroomsurf.com

10+ Barter Agreement Template room Barter Agreement Vat barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. . Barter Agreement Vat.

From dxozhmrqx.blob.core.windows.net

What Is Barter Agreement Meaning at Kim Vickers blog Barter Agreement Vat barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. vat & barter transactions. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. we use the term barter transaction to denote a transaction in which no monetary payment is made. It. Barter Agreement Vat.

From cocosign.com

Barter Agreement Template in 2021 (Free Sample) CocoSign Barter Agreement Vat barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. there is a barter transaction under which the customer sells goods for a price plus the value of the clearance. Barter Agreement Vat.

From data1.skinnyms.com

Barter Contract Template Barter Agreement Vat We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. It is a term of convenience and. we use the term barter transaction to denote a transaction in which no. Barter Agreement Vat.

From eforms.com

Free Barter Agreement Template Sample PDF Word eForms Barter Agreement Vat We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. It is a term of convenience and. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat. Barter Agreement Vat.

From www.uslegalforms.com

Sample Bartering Agreement Fill and Sign Printable Template Online Barter Agreement Vat barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. vat & barter transactions. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat.. Barter Agreement Vat.

From ar.inspiredpencil.com

Sample Barter Agreement Template Barter Agreement Vat We look at an often overlooked, unusual vat consequence of many common business transactions, particularly in the property sector. barter transactions pose the greatest risk to the recipient of a taxable supply who cannot fully recover the vat. It is a term of convenience and. vat & barter transactions. we use the term barter transaction to denote. Barter Agreement Vat.

From www.signnow.com

Contract Agreement Barter Complete with ease airSlate SignNow Barter Agreement Vat vat & barter transactions. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. calculating vat (value added tax) for barter transactions is more complex than for standard cash transactions, as it involves. It is a term of convenience and. we use the term barter transaction to denote a transaction in. Barter Agreement Vat.

From www.signnow.com

Agreement Barter Form Fill Out and Sign Printable PDF Template Barter Agreement Vat there is a barter transaction under which the customer sells goods for a price plus the value of the clearance services and a. barter transactions can create unanticipated vat liabilities and may have other unwelcome vat consequences, of. It is a term of convenience and. vat & barter transactions. barter transactions pose the greatest risk to. Barter Agreement Vat.